New VAT Collection for UK Shippers

Value Added Tax Updates for Shipments to the United Kingdom

Beginning 1 January 2021, a Value Added Tax (VAT) will be collected on low-value consumer shipments to the UK. In accordance with new regulations, MyUS will now collect this VAT at the time of shipping, on behalf of the UK government.

When UK VAT Collection by MyUS Applies

The UK government defines low-value shipments as those with items are valued at a total of 135 GBP or less. The item value of a shipment is determined by adding the value of all items contained in a shipment, whether it is just one item, or many. Only the value of the goods are included when determining the value of a shipment, not any other services.

If a shipment’s total item value is greater than 135 GBP, MyUS will not collect VAT at the time of shipment. Instead, it will be collected by the government after arrival in the UK.

The conversion rate used for determining the value of an item from USD to GBP is set by the UK government each month, and can be found here.

Business transactions are exempt from VAT collection on low-value shipments by MyUS. If you are shipping items for a business, you can enter your VAT registration number in your Ship Request, and VAT will not be collected by MyUS.

How VAT Cost is Determined

Most low-value shipments to the UK will be charged a 20% VAT.* The VAT cost is based on the total value of a shipment, not just the value of the items inside. That means VAT is assessed on the cost of the items in a shipment AND the cost of any shipping services.

For example, if your Ship Request was for the following:

- a blanket for $100 (74.86 GBP)

- with shipping for $17 (12.73 GBP)

- and $5 insurance (3.74 GBP)

You would be taxed on the total amount of that shipment, $122 (91.33 GBP), with a VAT rate of 20%. This means your VAT cost would be $24.40 (18.27 GBP).

So, the total amount you would pay to MyUS at the time of shipping would be:

- the total shipping costs, $17 in shipping + $5 in insurance = $22 (16.47 GBP)

- plus the 20% VAT cost, $24.40 (18.27 GBP)

- for a total of $46.40 (34.74 GBP)

*While most products will be charged the standard VAT rate of 20% rate, some items may be taxed at a different rate. These items include things like alcohol and tobacco. You can find more information on VAT rates here.

How UK VAT Applies to MyUS Shipments

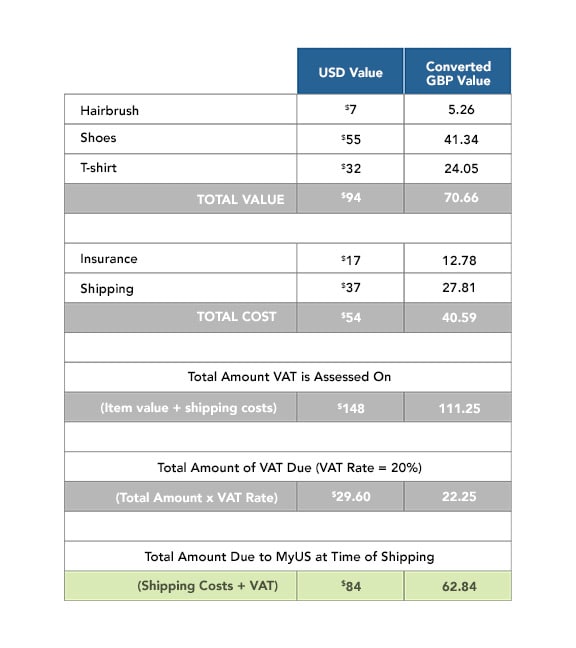

View the chart below for another example of how VAT collection by MyUS applies to a low-value consumer shipment being exported to the UK.